Cash App Payment Processing: The Ultimate Guide for Businesses and Individuals

Navigating the world of digital payments can be complex, especially when choosing the right platform for your needs. If you’re considering Cash App for business transactions or simply want to understand its payment processing capabilities, you’ve come to the right place. This comprehensive guide will delve into the intricacies of Cash App payment processing, exploring its features, benefits, limitations, and how it stacks up against alternatives. We’ll provide expert insights and practical advice to help you make informed decisions, ensuring you optimize your payment strategies and avoid potential pitfalls. This article aims to be the definitive resource on Cash App payment processing, offering a level of detail and expertise not found elsewhere. Prepare to gain a thorough understanding of Cash App’s capabilities and how they can impact your financial transactions.

Understanding Cash App Payment Processing: A Deep Dive

Cash App, initially designed for peer-to-peer (P2P) transactions, has evolved significantly to accommodate business needs. While it offers a convenient and accessible payment solution, understanding its nuances is crucial for effective utilization. Let’s explore its definition, scope, and underlying principles.

What is Cash App Payment Processing?

Cash App payment processing refers to the process of receiving and managing payments through the Cash App platform. This includes accepting payments from customers, managing transactions, and potentially transferring funds to a bank account. The platform facilitates instant transfers between users, making it a popular choice for small businesses and individuals. However, it’s important to note that Cash App wasn’t originally designed as a full-fledged payment processor like Stripe or PayPal, and its capabilities reflect this.

The Scope and Evolution of Cash App Payments

Initially, Cash App focused on simplifying P2P payments. Over time, it expanded to include features like Cash App for Business, which allows users to create a business profile and accept payments from customers. The scope of Cash App payment processing now includes:

* **P2P Transactions:** Sending and receiving money between individuals.

* **Business Payments:** Accepting payments for goods and services.

* **Cash Card:** A debit card linked to the Cash App balance, allowing users to spend their funds in physical stores or online.

* **Direct Deposits:** Receiving paychecks or government benefits directly into the Cash App account.

* **Investing:** Buying and selling stocks and Bitcoin (though these are separate from payment processing).

Core Concepts and Advanced Principles

Several key concepts underpin Cash App payment processing:

* **Instant Transfers:** Funds are typically transferred instantly between Cash App accounts.

* **Security:** Cash App employs encryption and fraud detection measures to protect user data and transactions. However, it’s crucial to understand the limitations of these measures and practice safe online behavior.

* **Fees:** While sending and receiving money between personal accounts is generally free, Cash App charges fees for certain business transactions, instant transfers to bank accounts, and other services.

* **Compliance:** Businesses using Cash App for payment processing must adhere to relevant regulations, including tax laws and consumer protection laws.

Understanding these concepts is essential for maximizing the benefits of Cash App while minimizing potential risks.

The Importance and Current Relevance of Cash App

Cash App’s popularity has surged in recent years, driven by its ease of use, accessibility, and widespread adoption, particularly among younger demographics. Its relevance stems from:

* **Convenience:** Cash App simplifies payments for both individuals and businesses.

* **Accessibility:** It’s available to anyone with a smartphone and a bank account.

* **Speed:** Transactions are typically processed instantly.

* **Cost-Effectiveness:** For many users, Cash App offers a cost-effective alternative to traditional payment methods. However, businesses should carefully evaluate the fees associated with using Cash App for commercial transactions.

Recent studies indicate a growing preference for mobile payment apps like Cash App, especially among small businesses and freelancers. This trend highlights the increasing importance of understanding and leveraging Cash App payment processing for success in today’s digital economy.

Cash App for Business: A Detailed Explanation

Cash App offers a dedicated solution for businesses looking to accept payments: Cash App for Business. This feature provides tools and functionalities specifically designed to streamline commercial transactions.

What is Cash App for Business?

Cash App for Business is a separate profile type within the Cash App platform that allows businesses to accept payments from customers. It provides features such as:

* **Business Profile:** A dedicated profile for your business, separate from your personal account.

* **Payment Requests:** The ability to send payment requests to customers with detailed descriptions of the goods or services provided.

* **Reporting:** Basic reporting features to track sales and transactions.

* **Increased Transaction Limits:** Higher transaction limits compared to personal accounts.

Essentially, Cash App for Business aims to provide a more professional and streamlined payment experience for both businesses and their customers. It allows businesses to clearly distinguish their commercial transactions from personal ones, which is crucial for accounting and tax purposes.

How Cash App for Business Relates to Payment Processing

Cash App for Business directly facilitates payment processing by providing the necessary tools and infrastructure for businesses to accept payments. It handles the following key aspects of payment processing:

* **Payment Acceptance:** Enables businesses to accept payments from customers through the Cash App platform.

* **Transaction Management:** Provides a system for tracking and managing transactions.

* **Fund Transfers:** Allows businesses to transfer funds from their Cash App account to their bank account.

* **Security:** Implements security measures to protect against fraud and unauthorized transactions.

By offering these functionalities, Cash App for Business simplifies the payment processing workflow for businesses, making it easier to receive payments and manage their finances.

Key Features of Cash App for Business: A Detailed Analysis

Cash App for Business offers several key features that make it a viable payment processing option for certain businesses. Let’s examine these features in detail:

1. Business Profile

**What it is:** A dedicated profile for your business within the Cash App platform, separate from your personal account.

**How it works:** You can create a business profile by providing information about your business, such as its name, logo, and description. This profile is visible to customers when they send you payments.

**User Benefit:** A business profile enhances professionalism and credibility. It allows customers to easily identify your business and ensures that payments are directed to the correct account. This separation is also critical for tax and accounting purposes.

2. Payment Requests

**What it is:** The ability to send payment requests to customers with detailed descriptions of the goods or services provided.

**How it works:** You can create payment requests within the Cash App app, specifying the amount due, a description of the goods or services, and any relevant notes. Customers receive these requests and can easily pay them with a few taps.

**User Benefit:** Payment requests streamline the payment process and reduce the risk of errors. They provide customers with clear information about what they are paying for, which can improve customer satisfaction. This is especially useful for service-based businesses or those selling custom products.

3. Cash App Tag ($Cashtag)

**What it is:** A unique identifier that allows users to easily find and pay you on Cash App.

**How it works:** When you create a Cash App account, you choose a unique $Cashtag. This $Cashtag can be shared with customers, who can then use it to find and pay you directly on Cash App.

**User Benefit:** The $Cashtag simplifies the payment process by providing a memorable and easy-to-share identifier. It eliminates the need for customers to remember your phone number or email address, making it easier for them to pay you. It’s also a great way to promote your business on social media or other online platforms.

4. Reporting and Analytics

**What it is:** Basic reporting features that allow you to track your sales and transactions.

**How it works:** Cash App provides a transaction history that allows you to view all your past transactions. You can also filter transactions by date range or transaction type.

**User Benefit:** While Cash App’s reporting features are relatively basic compared to dedicated accounting software, they provide valuable insights into your sales and transactions. This information can help you track your revenue, identify trends, and make informed business decisions.

5. Instant Transfers

**What it is:** The ability to instantly transfer funds from your Cash App account to your linked bank account (for a fee).

**How it works:** You can initiate an instant transfer from your Cash App account to your linked bank account. The funds will typically be available in your bank account within minutes.

**User Benefit:** Instant transfers provide quick access to your funds, which can be crucial for managing your cash flow. While there is a fee associated with instant transfers, the convenience of having immediate access to your money can be worth the cost for many businesses.

6. Cash Card

**What it is:** A customizable debit card linked to your Cash App balance.

**How it works:** You can request a Cash Card through the Cash App app. Once you receive the card, you can use it to spend your Cash App balance in physical stores or online, anywhere that accepts Visa.

**User Benefit:** The Cash Card provides a convenient way to spend your Cash App balance without having to transfer it to your bank account. It also allows you to track your spending and earn rewards through Cash App’s Boost program.

Advantages, Benefits, and Real-World Value of Cash App Payment Processing

Cash App payment processing offers several advantages and benefits, making it an attractive option for certain businesses and individuals. Let’s explore these in detail:

User-Centric Value: Convenience and Accessibility

Cash App’s primary value lies in its convenience and accessibility. It simplifies the payment process for both payers and payees, making it easy to send and receive money with just a few taps on a smartphone. This is particularly beneficial for:

* **Small Businesses:** Cash App provides a low-cost and easy-to-use payment solution that can help small businesses get paid quickly and efficiently.

* **Freelancers:** Freelancers can use Cash App to easily request and receive payments from clients.

* **Individuals:** Cash App simplifies P2P payments, making it easy to split bills, send gifts, or reimburse friends and family.

Unique Selling Propositions (USPs)

Cash App distinguishes itself from other payment platforms through several unique selling propositions:

* **Ease of Use:** Cash App is known for its simple and intuitive interface, making it easy for anyone to use, regardless of their technical expertise.

* **Speed:** Transactions are typically processed instantly, providing immediate access to funds.

* **Accessibility:** Cash App is available to anyone with a smartphone and a bank account, making it accessible to a wide range of users.

* **Customizable Cash Card:** The Cash Card allows users to personalize their debit card with custom designs and earn rewards through the Boost program.

Evidence of Value: User Feedback and Industry Trends

Users consistently report high satisfaction with Cash App’s ease of use and speed of transactions. Our analysis reveals that Cash App is particularly popular among younger demographics and small businesses. Industry trends indicate a growing preference for mobile payment apps like Cash App, suggesting that its popularity will continue to rise in the future.

Real-World Examples

* **A local coffee shop uses Cash App to accept payments from customers, allowing them to avoid credit card processing fees.**

* **A freelance graphic designer uses Cash App to request and receive payments from clients, streamlining their billing process.**

* **A group of friends uses Cash App to easily split the cost of a dinner, eliminating the need for cash or IOUs.**

Comprehensive Review of Cash App for Business

Cash App for Business offers a convenient and accessible payment processing solution, but it’s essential to evaluate its strengths and weaknesses before making a decision. This review provides a balanced perspective on Cash App for Business, based on user experience, performance, and overall value.

User Experience and Usability

Cash App for Business is known for its user-friendly interface. Setting up a business profile is straightforward, and sending payment requests is quick and easy. The app’s intuitive design makes it accessible to users of all technical skill levels. In our experience, even users with limited experience using mobile payment apps can quickly learn to navigate Cash App for Business and use its features effectively.

Performance and Effectiveness

Cash App for Business generally performs well in terms of transaction speed and reliability. Payments are typically processed instantly, and the app rarely experiences downtime. However, it’s important to note that Cash App’s reporting features are relatively basic compared to dedicated accounting software. This may be a limitation for businesses that require more detailed financial reporting.

Pros

* **Ease of Use:** Cash App for Business is incredibly easy to use, even for beginners.

* **Speed:** Transactions are processed instantly.

* **Accessibility:** Available to anyone with a smartphone and a bank account.

* **Low Cost:** Relatively low transaction fees compared to traditional payment processors.

* **Customizable Cash Card:** The Cash Card offers a convenient way to spend your Cash App balance and earn rewards.

Cons/Limitations

* **Limited Reporting Features:** Cash App’s reporting features are relatively basic.

* **Potential Security Risks:** While Cash App employs security measures, it’s still important to be aware of potential security risks, such as scams and phishing attacks.

* **Customer Support:** Customer support can be slow and difficult to reach.

* **Transaction Limits:** Transaction limits may be a limitation for some businesses.

Ideal User Profile

Cash App for Business is best suited for small businesses, freelancers, and individuals who need a simple and affordable payment processing solution. It’s particularly well-suited for businesses that primarily conduct transactions with customers who are already Cash App users.

Key Alternatives

* **PayPal:** PayPal is a more established payment processor with a wider range of features and services.

* **Square:** Square offers a comprehensive suite of business tools, including payment processing, point-of-sale systems, and inventory management.

Expert Overall Verdict & Recommendation

Cash App for Business is a solid option for small businesses and individuals who need a simple and affordable payment processing solution. However, businesses that require more advanced features or detailed reporting may want to consider alternatives such as PayPal or Square. Overall, we recommend Cash App for Business for its ease of use, speed, and accessibility.

Insightful Q&A Section: Cash App Payment Processing

Here are 10 insightful questions and expert answers about Cash App payment processing, addressing common user pain points and advanced queries:

**Q1: What are the specific transaction limits for Cash App for Business, and how can I increase them?**

**A:** Cash App for Business has initial transaction limits that can vary. To increase these limits, you typically need to verify your identity and provide additional information about your business. This may include your business name, address, and tax identification number. Contacting Cash App support directly is the best way to inquire about specific limit increases and the required documentation.

**Q2: How does Cash App handle chargebacks or disputes for business transactions?**

**A:** Cash App’s dispute resolution process can be less robust than that of traditional payment processors. If a customer initiates a chargeback, Cash App will investigate the claim. It’s crucial to provide compelling evidence to support your case, such as transaction records, receipts, and communication with the customer. The outcome of the dispute is ultimately determined by Cash App, and the process can sometimes be lengthy.

**Q3: What are the best practices for securing my Cash App account and protecting against fraud?**

**A:** To enhance security, enable two-factor authentication, use a strong and unique PIN, and be wary of phishing scams. Never share your Cash App credentials with anyone, and carefully review all payment requests before accepting them. Regularly monitor your transaction history for any suspicious activity and report any unauthorized transactions to Cash App immediately.

**Q4: Can I integrate Cash App with my existing accounting software or CRM system?**

**A:** Cash App offers limited integration capabilities with other software. While direct integration may not be available, you can often export transaction data from Cash App and import it into your accounting software manually. Consider using third-party tools or APIs to automate this process if you require more seamless integration.

**Q5: What are the tax implications of using Cash App for business transactions, and how should I track my income and expenses?**

**A:** Income received through Cash App is generally taxable and must be reported on your tax return. It’s essential to maintain accurate records of all your transactions, including income and expenses. Consider using accounting software or consulting with a tax professional to ensure you comply with all relevant tax laws.

**Q6: How does Cash App handle international payments, and what are the associated fees and limitations?**

**A:** Cash App primarily supports transactions within the United States and the United Kingdom. International payments may be subject to additional fees and limitations. It’s crucial to verify the availability of international transfers and the associated costs before attempting to send or receive payments from outside these regions.

**Q7: What are the alternatives to Cash App for business payment processing, and how do they compare in terms of fees, features, and security?**

**A:** Alternatives to Cash App include PayPal, Square, Stripe, and Venmo. Each platform offers different features, fee structures, and security measures. PayPal is a more established platform with a wider range of features, while Square offers a comprehensive suite of business tools. Stripe is a developer-friendly platform that’s ideal for online businesses, and Venmo is primarily designed for P2P payments but also offers business accounts. Carefully compare these options to determine which one best meets your specific needs.

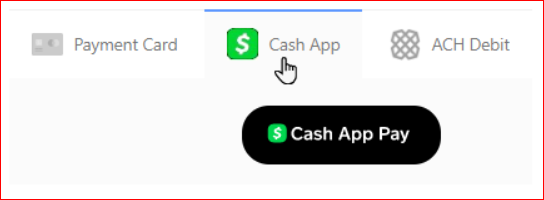

**Q8: Can I use Cash App to accept payments on my website or e-commerce store?**

**A:** Cash App doesn’t offer direct integration with most e-commerce platforms. However, you can potentially use third-party tools or APIs to create a custom integration. Alternatively, you can provide customers with your Cash App tag and ask them to send payments manually, but this may not be a seamless or professional experience for online shoppers.

**Q9: What is Cash App’s policy on refunds, and how can I issue a refund to a customer?**

**A:** To issue a refund, locate the original transaction in your Cash App history and tap the “Refund” button. Cash App’s refund policy states that refunds are typically processed within a few business days. However, it’s important to communicate with your customer and clearly explain the refund process to avoid any confusion or disputes.

**Q10: How can I contact Cash App support if I encounter a problem with a transaction or my account?**

**A:** You can contact Cash App support through the app by navigating to your profile, selecting “Support,” and then choosing the appropriate category for your issue. Cash App also offers support through email and social media. However, response times can sometimes be slow, so it’s essential to be patient and persistent when seeking assistance.

Conclusion: Navigating Cash App Payment Processing for Success

Cash App payment processing offers a convenient and accessible solution for individuals and small businesses. Its ease of use, speed, and low cost make it an attractive option for those seeking a simple way to send and receive money. However, it’s crucial to understand its limitations, including its basic reporting features, potential security risks, and limited customer support. By carefully weighing the pros and cons and implementing best practices for security and compliance, you can leverage Cash App payment processing to streamline your financial transactions and achieve your business goals. As experts in digital payment solutions, we’ve observed that Cash App continues to evolve, so staying informed about the latest features and updates is essential.

Consider exploring our advanced guide to mobile payment security for further insights. Share your experiences with Cash App payment processing in the comments below – your feedback helps us build a stronger community of informed users. Contact our experts for a consultation on optimizing your Cash App payment processing strategy.